Beginning January 1, Minnesota’s motor fuel taxes will increase by nearly 12% for diesel, gasoline, biodiesel, and other fuels, due to a state law passed last year that links tax hikes to rising highway construction costs.

Under the 2023 legislation, the Minnesota Department of Revenue has determined the new tax rates, meeting the August 1 deadline for adjustments for the upcoming year.

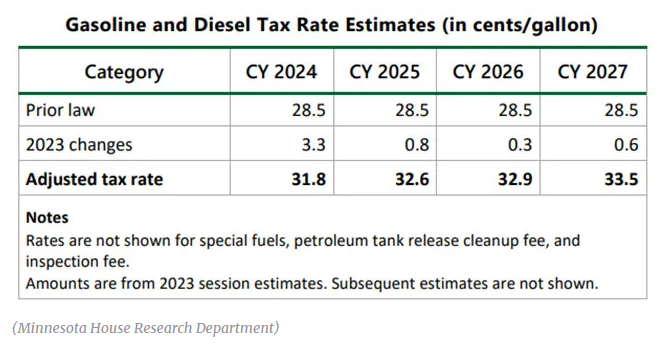

Starting January 1, the per-gallon tax on motor fuels will increase from the current 28.5 cents to 31.8 cents for diesel, biodiesel, and gasoline. Ethanol will see a rise from 20.25 cents to 22.59 cents per gallon, marking an 11.6% increase.

“The new combined rate will be $0.318, consisting of the $0.283 excise tax rate for gasoline and special fuel products, plus the $0.035 per gallon debt service surcharge. Alternative fuels rates will also be increased,” the state revenue department noted.

The motor fuel tax increase is the result of an annual adjustment mandated for each type of fuel, which is tied to the rises in the Minnesota Highway Construction Cost Index.

“The adjusted rate must be calculated each Aug. 1 and goes into effect the following Jan. 1 for the next 12 months. Starting in 2025, the annual percentage change in tax rate is capped at 3%,” noted a state legislative report from January explaining the changes.

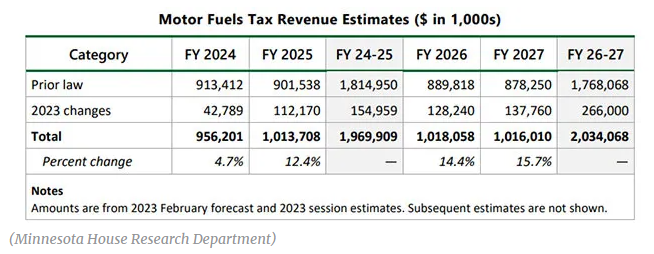

The upcoming motor fuel tax increase is projected to generate $1 million in revenue by the end of fiscal year 2025. These funds will be allocated to state transportation projects.

Across the country, rising highway construction costs have diminished the purchasing power of bipartisan infrastructure funds granted to state transportation departments. The Bureau of Transportation Statistics, part of the U.S. Department of Transportation, defines the National Highway Construction Cost Index by examining successful bids on state highway projects, utilizing price quotes for specific items like materials and labor.

“The average price charged is calculated for each item in each state, and these price changes are then combined into a national index based on a market basket of items,” noted BTS.

In a 2023 review, the BTS reported that the National Highway Construction Cost Index hit a record high in the second quarter of 2023, rising 3.8% from the previous quarter. However, this increase was smaller compared to the second quarter of 2022, when the NHCCI surged by 11.9%, marking the fastest growth of any quarter since record-keeping began in 2003.