Industry experts emphasize that fleets should make this essential detail their top priority when integrating electric trucks: determining where to charge them. Paul Rosa, the senior vice president of procurement and fleet planning at Penske, stated that fleets should focus on establishing charging infrastructure before purchasing the trucks.

“You’re going to be able to get a vehicle in that window of time from when you start the infrastructure to when it’s energized,” he said. “So focus on the infrastructure first, or in this case, put the cart before the horse.”

Despite the favorable timing for fleets, the costs are substantial, making delays unaffordable. A Class 8 battery-electric truck can cost around $400,000, though government incentives can reduce this amount. A March report from the Clean Freight Coalition indicated that fully electrifying the U.S. commercial truck fleet would require about $620 billion in charging infrastructure investments, with utilities needing to invest an additional $370 billion, bringing the total to nearly $1 trillion.

Paul Rosa, from Penske, which operates Classes 3-8 electric vehicles, is optimistic about the current vehicle technology. However, he emphasized that fleets must evaluate if it is feasible from a total-cost-of-ownership perspective. Rosa also noted that infrastructure technology is advancing and highlighted the importance of communication and relationship-building between fleets and utility providers.

“It’s about having that interaction with them on a regular cadence and regular basis, and that’s one of the things we’re recommending to all of our customers,” he said. “Go and meet with them if you have interest today or in the next couple of years to have an electric vehicle or vehicles. Please go meet with them now.”

Rob Graff, senior technical adviser with the North American Council for Freight Efficiency, emphasized that the first step for fleets considering electric trucks is to contact their utility provider. Trucking companies have different needs, and utility rates and availability can vary, so what works for one may not work for another.

Finding the right contact at the utility can be challenging. Fleets should also reach out to their truck manufacturer, which often has established relationships with individuals who can assist with depot, truck, and utility planning. Additionally, consulting with a similar fleet that has already transitioned to electric trucks can be beneficial.

“Talk to someone other than the people trying to sell you charging equipment because they maybe have an incentive to sell you larger equipment than you need,” Graff said.

Miles Archer, Ryder’s senior manager of charging and partnerships, emphasized the importance of fleets engaging with utility providers as early as possible. Ryder, which operates over 100 electric vehicles and plans to expand, discusses with utilities whether the current power capacity is sufficient or if additional power needs to be brought in.

Archer noted that if a fleet can demonstrate concrete, long-term power demand, it becomes easier for the utility to justify infrastructure investments to the regulatory commission. Without charging infrastructure, trucks become stranded assets; however, fleets also want to avoid installing costly infrastructure without having trucks to utilize it.

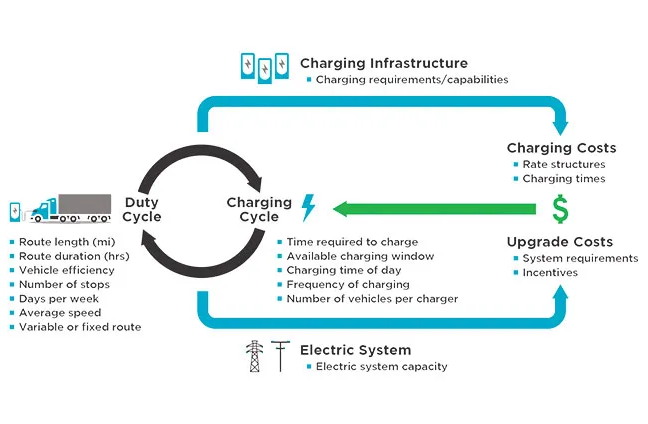

Rob Graff highlighted that costs depend on two main factors: the megawatts provided (the size of the “pipe”) and the amount of electricity used. Smaller pipes cost less for both fleets and utilities, so slower charging might be a cost-saving strategy.

Archer also mentioned that fleets can reduce costs by appropriately sizing their charging infrastructure to their actual needs.

“A new customer may look at the market and say, ‘I need a 350- kilowatt charger because that’s nice and fast, and I want to be as fast as possible,’ ” he said. “But the vehicle that they’re considering is at 150 kilowatt, that’s where it’s capped, and it has a 10-hour dwell time, and it runs all of a hundred miles in a day. So that would pair very well with a 30-kilowatt charger overnight with sufficient time to deal with any outlier cases.”

Archer advised that comprehensive discussions should be held with the finance department about infrastructure costs, with fleet operators about routes and dwell times, and with facilities operators about possible improvements.

In some cases, nearby charging locations can be utilized. Carlo Rodriguez, Ryder’s managing director for the EV and advanced vehicle technology team, shared an example where a customer fleet had light-duty vans arrive before their charging infrastructure was ready. Ryder found a nearby 7-Eleven convenience store with fast charging capabilities that they could use.

Challenges Ahead

Fleets might be shocked by the high costs of infrastructure projects, Rodriguez noted, often considering these expenses as annual or over the vehicle’s term. However, these costs can be depreciable real estate improvements.

Ryan Bankerd, UPS’ corporate director of automotive sustainability, pointed out that while installing limited charging capabilities might be relatively straightforward, scaling up infrastructure is more challenging due to utilities and permitting issues. This process necessitates a partnership between the utility, government agencies, and the fleet.

“With any sort of fracture in those three relationships, you could find yourself with stranded assets or significant delays,” he said.

Bankerd shared an instance where UPS required an easement for a Class 8 site to place infrastructure above a water main and an electrical conduit. The county owned one and the city the other, with standard language in place that initially prevented either from agreeing to the easement. Through its partnerships and collaboration with the utility, UPS eventually found a solution, though assets were stranded for a period.

He cautioned that smaller fleets might encounter similar unexpected challenges.

“You don’t know what’s sitting in your property until you start digging it up and laying in the cables,” he said. “You don’t know what’s sitting in the street just outside your property.”

Bankerd advised smaller fleets to monitor the market and learn from larger fleet initiatives. Understanding which locations have strong partnerships and infrastructure availability is crucial for smaller fleets to achieve their sustainability goals effectively.

He also emphasized the importance of hiring reputable consultants before entering the electrification space.

Rob Graff from NACFE highlighted that the challenge of electrification is compounded by recent changes to the grid. The grid now relies more on distributed generation from decentralized, intermittent sources like rooftop solar and wind turbines, which contrasts with the historically stable load from centralized power plants. Moreover, there has been significant deferred maintenance, and energy demand, after remaining flat for about two decades due to energy conservation efforts like LED lighting, has started to increase again in recent years. Graff stressed the need for grid expansion but noted uncertainties about funding sources.

Regarding infrastructure solutions, while fleets work on internal challenges, companies like Cyclum and Voltera are exploring innovative ways to provide power solutions on the road.

Cyclum is developing a network of charging stations combined with upscale convenience stores featuring amenities for drivers. Shaun Lee, director of field operations, outlined plans to open four to eight locations next year, beginning with Tulare, Calif. The company aims to establish 30 to 40 sites annually over the next decade. Each site will offer a range of fuels including electric charging, hydrogen, compressed natural gas, renewable diesel, and traditional diesel.

These sites can be constructed using modular configurations, with the Tulare location planned to include four super-fast chargers, 10 fast chargers, and 35 overnight chargers. They will also accommodate 18 to 36 charging spots for passenger vehicles and provide services for autonomous vehicles with on-site attendants. Each facility is estimated to cost around $35 million but will benefit from 30% to 35% in tax credits. Lee noted strong backing from the energy sector.

Cyclum aims for its sites to achieve carbon negativity by generating electricity on-site using renewable natural gas and, in some cases, wind turbines. This approach is expected to reduce charging costs while promoting sustainability.

“Basically, we’re operating just as any truck stop would do, only we’re doing it from a whole new playbook, right?” he said. “So we’re generating renewable energy on the site. We’re utilizing a better level of food services. And we’re just redrawing the lines when it comes to how we’re providing service in the marketplace.”

Voltera, on the other hand, specializes in constructing large-scale charging stations tailored for specific fleet customers. CEO Matt Horton explained that the company collaborates closely with utilities to identify suitable locations with accessible electricity before developing the properties. They target areas with clusters of trucking companies and high truck traffic volumes along regional routes.

In the past year, Voltera allocated approximately $150 million towards property acquisitions and development, with plans to match or exceed that investment this year. Partnering with EQT Partners, a prominent private equity fund, has bolstered their efforts.

Recently, Voltera inaugurated a $15 million facility near the Port of Long Beach, California, dedicated to serving Einride, capable of charging up to 200 Class 8 electric trucks daily via 65 DC fast charging stations. They have also launched another facility in Phoenix catering to lighter-duty vehicles, with 19 additional sites in various stages of development and more in the pipeline. Some of these projects are expected to cost over $30 million each, including a forthcoming site at the Port of Savannah, Georgia, serving multiple customers.

Looking forward, Horton anticipates a proliferation of charging stations akin to Voltera’s model. Once these stations are recognized as lucrative investments, he predicts an influx of tens of billions of dollars into the market.

“Very soon, you’re going to start to see facilities like the one we built near Long Beach popping up everywhere. You look at a facility like that, that really is a vision of what’s coming,” he said. “So if you want to go see the future, it’s available near Long Beach today.”