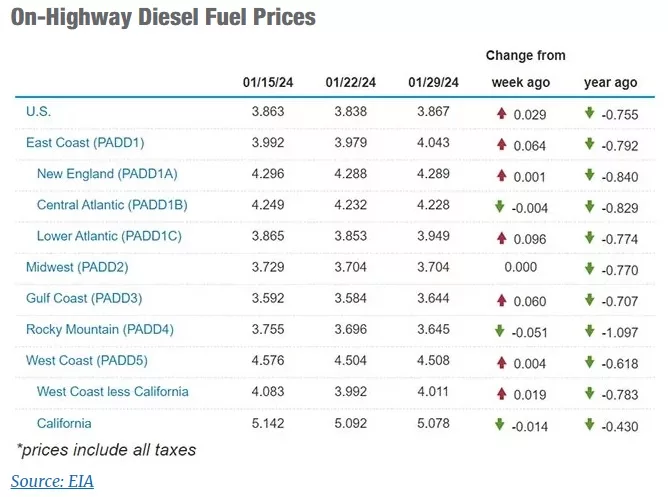

This week, there has been a 2.9-cent increase in the national average diesel price, as reported on January 29 by the Energy Information Administration. Currently standing at $3.867 per gallon, diesel is now 75.5 cents cheaper compared to the same period last year.

Throughout January’s five reporting dates, the national average diesel price has experienced fluctuations, alternating between decreases and increases. In the previous week, there was a 2.5-cent drop following a 3.5-cent increase in the week before.

Among the regions, the diesel price increased in six, remained unchanged in one, and decreased in three. The Rocky Mountain region witnessed a decline of 5.1 cents, while the Lower Atlantic region saw a rise of 9.6 cents. Meanwhile, the Midwest reported a stable price.

Gasoline prices also saw an uptick, climbing by 3.3 cents per gallon, resulting in a national average of $3.095.

“We’ve seen the national average price of gasoline bounce back up after cold weather-related refinery shutdowns pushed up the wholesale price of gasoline,” Patrick De Haan, Gas Buddy head of petroleum analysis, said on his blog Jan. 29, adding that prices could rise in the spring. “Plus, recent gross domestic product data and new attacks in the Red Sea have pushed oil prices to their highest level since November.

“While prices have inched up and may continue to slowly rise, I believe the larger increases will be witnessed in a few weeks as we enter mid-February, lasting through April or May, during which the national average could rise 35 to 85 cents per gallon. Other issues and tensions could complicate how quickly prices rise or how high they go, so while the rise is not completely charted, it could deviate from our expectations.”

The Energy Information Administration (EIA) concluded its 2023 oil production report, revealing that U.S. energy producers processed 13.2 million barrels per day in December. This marked the third occurrence of reaching this production level in 2023, with September and October being the other months. Notably, November saw only a slight decrease, underscoring that the last four months of the year sustained record-high oil production.

Throughout 2023, there was no month where oil production dropped below 12.5 million barrels per day, and the only months at that level were January and February.

For the entire year, the average daily domestic oil production stood at 12.9 million barrels, reflecting a notable increase of 1 million barrels compared to the 2022 level.

It’s worth mentioning that domestic production experienced a dip in January, attributed to severe cold weather impacting one of the nation’s most productive oil reserves.

According to the Energy Information Administration (EIA), production experienced a decline of approximately 1 million barrels per day, reaching 12.3 million for the week ending on January 19. Simultaneously, commercial crude inventories in the United States witnessed a substantial decrease of 9.2 million barrels during the same period.

This dip in production was attributed to adverse weather conditions in North Dakota, specifically impacting the Bakken Formation, which spans significant areas of North Dakota, Montana, and the Canadian provinces of Manitoba and Saskatchewan. Notably, North Dakota holds the position of the third-largest crude-producing state in the U.S. The state’s pipeline authority indicated that the weather played a role in the production drop, accounting for as much as a 700,000-barrel per day reduction.

“We have seen prices start to inch up, and the chances of seeing gasoline’s national average below $3 a barrel have been dashed,” oil industry analyst Phil Flynn with Price Futures Group told Transport Topics. Flynn blamed the increase on the recent Red Sea assaults and the attacks by suspected Iranian-backed rebels that killed three U.S. service members who were stationed at a facility along the Jordan-Iraq border.

“Fundamentally, the oil markets are on solid ground. But [Jan. 29], the market spiked on the threat of the U.S. response to what was seen in Jordan. The risk of a military response is growing, and the risks to a disruption in the supply are increasing. The possibility of a significant price spike still looms, and the markets are waiting and seeing to see what happens. The markets [are] on edge.”

Flynn expressed that he wouldn’t be surprised if West Texas Intermediate crude oil reaches $80 per barrel by the end of the week. As of January 29, the closing price for oil was $76.92, slightly below the $77.90 it traded for a year ago. Throughout the past year, oil exhibited a range, fluctuating between $68 and $93.

In terms of operational rigs, the weekly Baker Hughes rig count reported 621 rigs in operation as of January 19. This marked an increase of one rig compared to the previous week but a notable decline of 150 rigs from the same period last year. Meanwhile, the Canadian oil rig count saw a seven-unit increase from the previous week, totaling 230, yet still down by seven from the corresponding period in 2023.