In September, there was a 7.7% increase in the sales of medium-duty trucks in the retail sector compared to the same period last year, as reported by Wards Intelligence.

The overall retail sales of trucks falling within Classes 4-7 reached 20,216 units, marking the sixth consecutive month of year-over-year growth and the seventh for the year 2023. However, it’s worth noting that there was a 12.2% decline in sales compared to the 23,026 units sold in August.

ACT Research Vice President Steve Tam expressed some surprise regarding the results in September, as he had initially anticipated a smaller decline compared to August due to robust production numbers in the eighth month of the year.

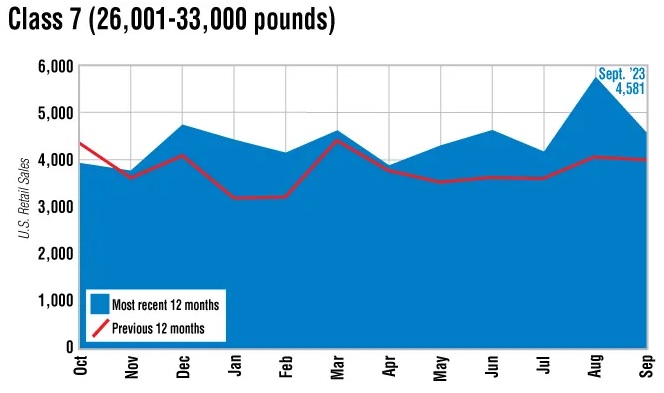

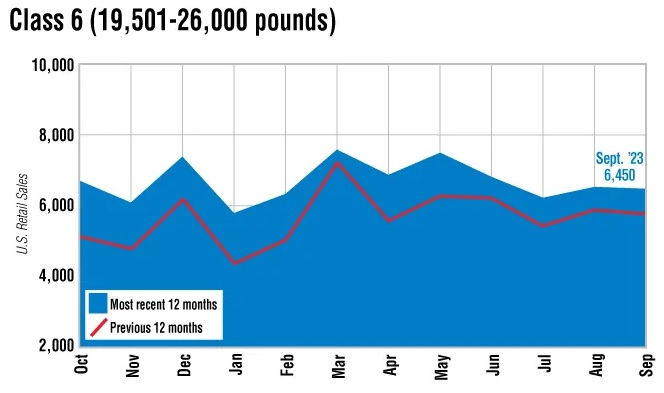

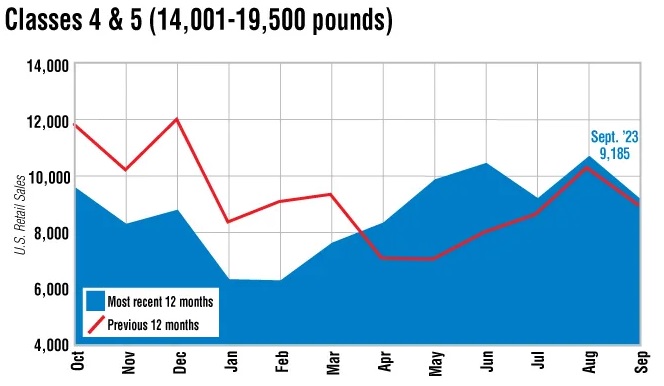

Sales in each category of medium-duty trucks experienced growth when compared to the same period in the previous year.

Class 7 had the most significant percentage increase, with a 15.7% rise, resulting in 4,581 units sold, up from 3,959. Class 6 also saw a notable 11.6% increase, reaching 6,450 units from 5,782. Classes 4 and 5 combined showed a more modest 1.8% increase in year-over-year sales, totaling 9,185 units compared to 9,022 in the previous year.

Daimler Truck North America’s Freightliner brand led the sales in Class 7 trucks with 1,814 units sold. Ford topped the charts in Class 6, moving 1,774 units, and also dominated Class 5 with 3,634 units sold. Isuzu took the lead in Class 4 trucks with 984 units sold.

For the first nine months of 2023, the cumulative sales of trucks in Classes 4-7 amounted to 178,907 units, reflecting a notable 10% increase when compared to the 162,617 units sold in the same period the previous year.

Steve Tam noted that the sales performance in 2023 has been exceeding earlier projections. According to ACT Research’s forecasts, retail sales in the medium-duty truck sector are anticipated to be 9% higher in the first nine months of the year compared to 2022.

However, the final quarter of the year faces significant uncertainty in terms of sales expectations, primarily due to the United Auto Workers strikes affecting five Mack Truck sites and the Ford Kentucky Truck Plant.

The United Auto Workers (UAW) represents Mack workers in several states, including Pennsylvania, Maryland, and Florida, which encompasses facilities like the Lehigh Valley Operations and Hagerstown Powertrain Operations. Earlier, union leaders had reached a tentative agreement with the company on October 1, but a significant 73% of the members voted against the proposed five-year deal. Consequently, employees went on strike starting on October 9.

In September, Mack Trucks managed to sell 293 Class 6 trucks and 159 Class 7 trucks.

Regarding the Ford strike, it commenced on October 11 at a plant responsible for manufacturing the F-250 and F-350 full-size “Super Duty” pickup trucks. Analysts at Deutsche Bank estimate that the daily production of F-250 and F-350 vehicles at the Kentucky Truck Plant averages around 729 units.