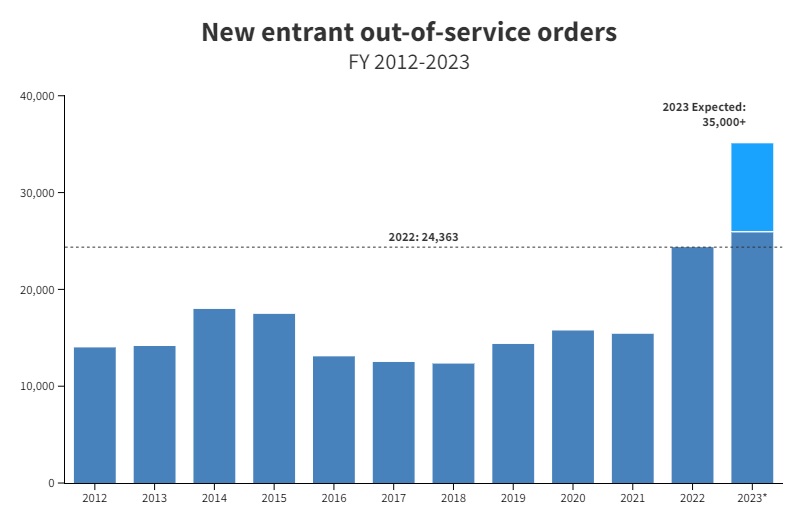

According to the most recent government data, there is a significant increase expected in the issuance of orders that prohibit new carriers from operating in 2023. This increase in out-of-service (OOS) orders for new carriers has been in sync with the remarkable rise in the number of new carriers authorized to operate since 2020.

The Federal Motor Carrier Safety Administration began monitoring these OOS orders in 2012. After reaching a record high of 24,363 in the fiscal year 2022, it was already surpassed by June 30 in the fiscal year 2023, with 25,955 OOS orders, as reported by the FMCSA’s Motor Carrier Management Information System (MCMIS).

While we won’t have complete data for the entire fiscal year, which ended on September 30, until December, it is highly likely that the total number of OOS orders issued in fiscal year 2023 will exceed 35,000, based on the trends observed over the past eight quarters (as shown in the chart).

New-carrier entrants, as per the FMCSA’s definition, refer to motor carriers that are not based in Mexico but apply for a U.S. Department of Transportation identification number with the intention of commencing operations in interstate commerce.

The FMCSA takes action by conducting a safety audit within the initial 18 months of a new-entrant carrier starting its operations. If the carrier does not pass the audit, declines to participate in the audit, or is unresponsive and cannot be contacted for the audit, the agency then issues an out-of-service (OOS) order.

“A new entrant may not operate in interstate commerce on or after the effective date of the OOS order,” according to FMCSA regulations. In addition, “a new entrant that operates a [commercial motor vehicle] in violation of an OOS order is subject to federal fines and penalties.”

The FMCSA did not provide an immediate comment regarding the surge in new-entrant out-of-service (OOS) orders and its implications.

One plausible explanation for this increase is the simultaneous rise in operating authorities to historic levels in recent years. Many of these new operating authorities belong to single-truck operators or small fleets. Consequently, the surge in new-carrier OOS orders may be a natural outcome of this trend, as there is a larger pool of potential recipients for OOS orders.

Daniel Koors, who is both an owner-operator and a council member for CDL Drivers Unlimited, an advocacy group focused on enhancing working conditions and lifestyles for commercial drivers, expressed his lack of surprise at the record-high OOS orders. He believes that the current economic conditions within the trucking industry are expediting this trend.

“It’s simple — there’s not enough money in the market right now to maintain these new drivers,” Koors told FreightWaves. “Many are barely able to maintain their homes let alone their trucks.”

Koors pointed out that apart from maintenance expenses, factors such as fuel costs and freight rates are presenting challenges for new entrants in the industry.

“I would say a majority of the new entrants that have fallen out are the ones that started during the pandemic,” he said. “They don’t have the back-office support, they don’t have the capital, they jumped in when things were hot, and they didn’t set up the relationships needed to get them through this downturn.”

The noteworthy increase in new-entrant out-of-service (OOS) orders could be an indication of a broader decline in the trucking industry’s capacity. This situation contributes to the mounting evidence that there is a looming “capacity bubble” on the horizon. Such a bubble could potentially lead to an adjustment in the market, resulting in higher freight rates as it seeks to rebalance supply and demand.