In a shipping industry where people are constantly wondering if we’ve reached the lowest point yet, the latest data from the Cass Freight Index suggests that we may be approaching the bottom.

The headline of this month’s report is “Moving Along the Lowest Point.” Tim Denoyer from ACT Research, who provided commentary on the June Cass data, stated that the decrease in volume seems to be reaching its later stages. After a prolonged period of sluggishness, Denoyer believes that the U.S. freight transportation industry is on the verge of a new cycle.

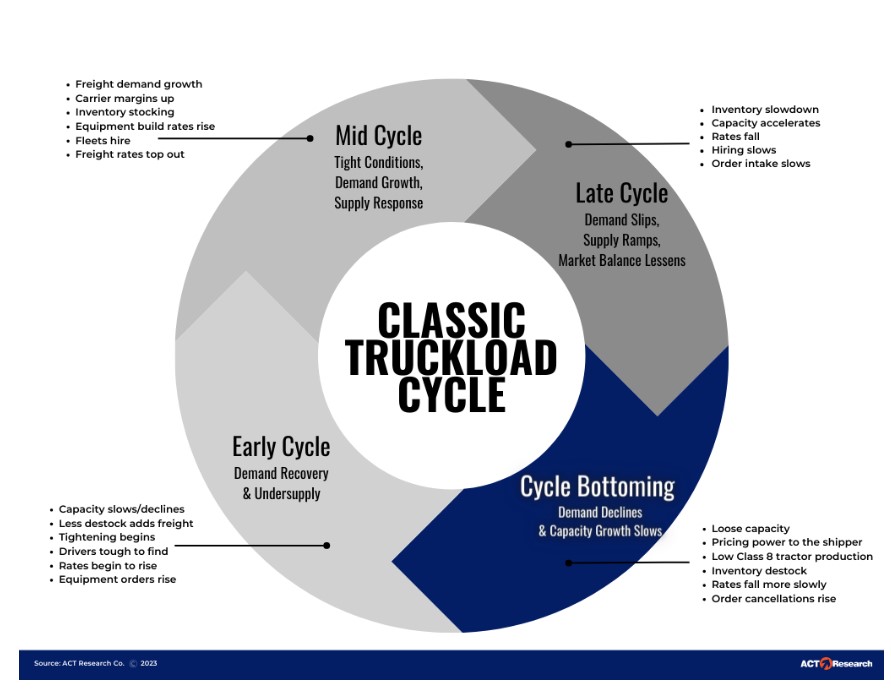

However, Denoyer refers to this upcoming phase in the freight market as “cycle bottoming.” The accompanying graphic in the report illustrates several indicators of this cycle, including ample capacity, shippers having more bargaining power, reduced production of Class 8 tractors, a slower decline in rates, and an increase in order cancellations. The key elements highlighted in the “wheel” of cycle bottoming are “declining demand and slower capacity growth.”

According to Denoyer, there is one aspect missing in the current market that is typically associated with cycle bottoming: lower levels of equipment production. He points out that as the production rates for Class 8 trucks remain high, it puts pressure on fleets to find drivers for these trucks.

Looking at the main categories of the Cass Freight Index, the shipments component experienced a 1.6% decline from May to June. After adjusting for seasonal variations, this decline amounted to 1.9%.

When compared to the same period last year, the index showed a decline of 4.7%. In comparison, the year-on-year decline in May was 5.6%. Therefore, the rate of annual decline was slower in June compared to May. According to Cass, after seasonal adjustments, the shipments index is currently 12% lower than its peak during the December 2021 cycle.

The report highlights that the current “downcycle” has been ongoing for 18 months, characterized by 18 consecutive year-on-year declines. In comparison, the previous three downcycles lasted between 21 and 28 months, as stated by Cass.

There is optimism regarding shipments, as the report suggests that the primary challenges to freight volumes, such as declining real retail sales trends and ongoing destocking, are starting to shift. Denoyer writes that improving real incomes and the worst of the destocking phase being in the past are contributing factors to this positive outlook.

Regarding expenditures, the Cass Index indicates a sequential decline of 2.6% from May, with a significant drop of 24.5% from the previous year. As a result of the declining shipments and expenditures, Cass concludes that rates decreased by 1% in June compared to May.

After adjusting for seasonal variations, the expenditures index decreased by 2.8% from May, with shipments declining by 1.9% and rates falling by 0.9%.

It’s worth noting that fuel is included in the expenditures index. On the other hand, the Cass Truckload Linehaul Index, which excludes fuel and is theoretically expected to be less volatile, experienced a smaller decline of 0.4% in June compared to May. This decline is significantly less than the 2.6% month-to-month decline observed in May compared to April.

However, the recent trend of a narrower decline in the past two months obscures an important fact, as highlighted by Cass. The average decline of 1.5% over the past two months is nearly double the 0.8% decline observed in the preceding six months.

Cass explains in the report that their index serves as a comprehensive indicator of the truckload market, encompassing both spot and contract freight. As spot rates have already experienced significant decreases, it is expected that the larger contract market will continue to adjust downward.

In addition to the 4.7% decline in the shipments index, other Cass indices also demonstrate substantial year-on-year declines. The expenditures index shows a decline of 24.5%, inferred freight rates are down by 20.9%, and the truckload linehaul index has experienced a decline of 14.1%.

Morgan Stanley sees an upturn

The Cass report’s indication that the market may have started to reach its bottom aligns partially with a report from Morgan Stanley. According to Morgan Stanley, they anticipate an increase in truck rates, as measured by their company, to reach $2.02 per mile in six months, up from the current rate of $1.68, and to further rise to $2.33 per mile within 12 months.

Furthermore, Morgan Stanley’s Truckload Sentiment Survey (TLSS), led by Ravi Shanker’s team, provides an overall positive outlook compared to the most recent update.

“In a reversal from last update, current supply and rate sentiment switched from underperform to outperform this week, while current demand and 3-month forward supply sentiment switched to underperform,” the report said.

According to the survey’s respondents, expectations for trucking rates have remained relatively stable, although they are currently at the lowest levels seen in 2023. There was a slight upward shift in mid-June, but rates are still relatively low.

However, there are significant uncertainties in the market, particularly regarding the fate of LTL carrier Yellow Corp. (NASDAQ: YELL) and the potential for a strike at UPS (NYSE: UPS). The report suggests that if Yellow Corp. were to close or if UPS were to experience a walkout, it could introduce significant upward pressure on rates, especially in the short term. These events have the potential to disrupt the market and lead to rate increases.

Cowen/AFS report also sees a reversal

The TD Cowen/AFS Freight Index also suggests a potential rebound in freight rates. This index is presented as a percentage above a baseline set in January 2018. The projection indicates that in the third quarter, the index will be 6.6% above the baseline, slightly higher than the 6.4% in the second quarter. The index reached its peak in the first quarter of 2022, when it was 25.7% above the baseline. In the second quarter of 2020, at the start of the pandemic, it was 0.4% below the baseline.

If the projected bounce of 6.6% in the third quarter is realized, it will signify a reversal of the continuous decline seen from the first quarter’s peak of 25.7% to 22.8% in the second quarter of the following year. The index then slid sequentially over the next four quarters, reaching 17%, 12.9%, and 7.8% before reaching 6.4% in the second quarter of this year.

In a statement accompanying the data, AFS CEO Tom Nightingale emphasized that although the possibility of market turmoil grabs attention, current market conditions still favor shippers. He noted that even though the truckload sector is showing signs of price resilience, overall market conditions are favorable for shippers.

Source: www.freightwaves.com