As we approach the upcoming long weekend, the dynamics in the transportation industry favor shippers rather than carriers, especially when it comes to relying on the spot market for finding or transporting freight. Recent data indicates that conditions have improved for shippers, while rates on the spot market have remained challenging, particularly for those in need of flatbed loads.

In the United States, the sales of used trucks are still robust, although prices have started to decrease from the exceptionally high levels seen last year. This is positive news for buyers, as there is now a greater inventory of used trucks available at more reasonable prices.

There is good news for van haulers operating in the spot market, but unfortunately, the situation is not as favorable for flatbed haulers.

According to the latest data for the week ending on June 23, the spot market in the United States demonstrated strength for van and reefer haulers, but weakness for those seeking flatbed loads.

Truckstop, a leading loadboard, reported that both dry van and refrigerated loads experienced pricing strength during this period. On the other hand, flatbed rates witnessed a significant decline, marking the largest price decrease observed since March. Conversely, van rates reached their highest point since mid-May, indicating a strong performance in that sector.

In summary, the week of June 23 showcased positive trends for van and reefer haulers in the U.S. spot market, with robust pricing, while flatbed haulers faced a notable decrease in rates.

“The real test of van rates’ strength will be the current week, however,” the company noted. “Spot rates during the final week of June typically are the strongest of the year for refrigerated and dry van except for rates during the December holiday period. This week will need to produce large rate gains for both equipment types if they are to match seasonal expectations, but that result is not out of the question.”

How are shippers faring?

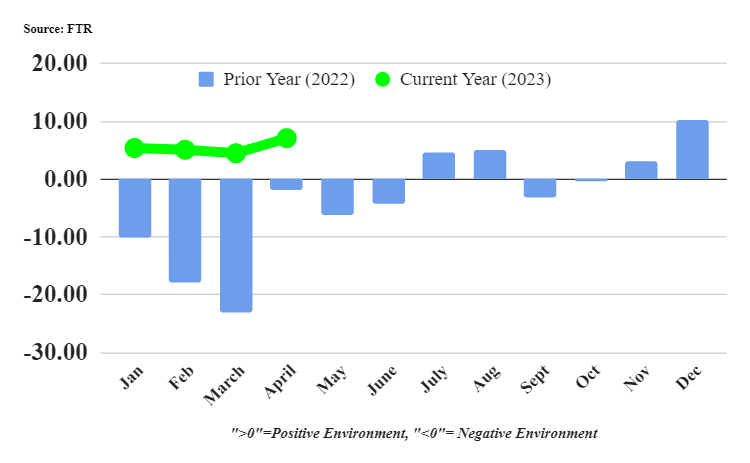

In April, there was a noticeable improvement in conditions for shippers, as indicated by FTR’s Shippers Conditions Index (SCI). The index rose from a reading of 4.5 in March to 7.1.

This positive shift in shipper conditions can be attributed to a few key factors. Firstly, the freight rate environment weakened during this period, providing more favorable terms for shippers. Additionally, there was a reduction in carrier utilization, further benefiting shippers. These factors outweighed the effects of stronger freight demand and a gradual decrease in fuel costs observed in April.

Looking ahead, industry forecaster FTR predicts that shippers will continue to operate within a positive environment until mid-2024. This suggests that the overall conditions for shippers are expected to remain favorable in the foreseeable future.

“Shippers conditions improved in April as weaker rates and carrier utilization helped support shippers,” said FTR vice-president of rail and intermodal Todd Tranausky. “The outlook is for a firmly positive outlook for shippers in the economic balance of power between themselves and carriers for at least another 12 months. Economic uncertainty or a higher-than-expected amount of economic weakness could bump that time frame further out into the future and extend the good ride shippers have had over the last few months.”

Used truck prices coming back to Earth

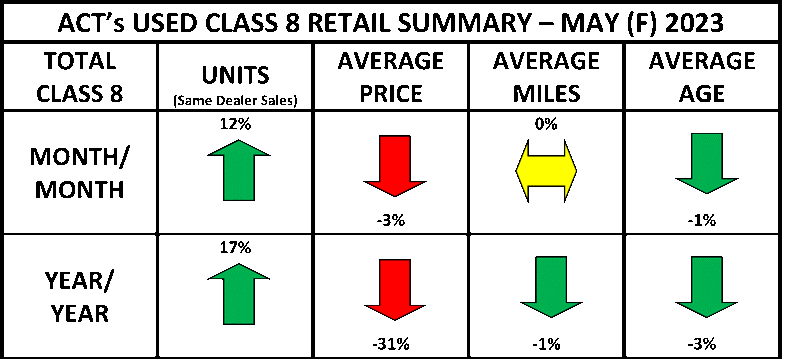

The retail sales of used Class 8 trucks in the United States are showing signs of pricing returning to more realistic levels, while the demand for used equipment remains strong. According to ACT Research, same-dealer sales of used trucks experienced a 12% growth in May compared to April.

However, despite the increase in sales, the prices of used Class 8 trucks declined by approximately 3% from the previous month. Furthermore, when compared to the same period last year, prices were down by a significant 31%.

These observations suggest that the market for used Class 8 trucks is becoming more balanced, with prices aligning closer to normal levels. Despite the price decline, demand for used equipment remains high, indicating continued interest from buyers in the market.

“Sales usually slow 4-5% in May, so the increase was not only uncharacteristic, but also presents a bit of a conundrum in the context of the current economic and freight environments,” said Steve Tam, vice-president at ACT Research. “As owner-operators and smaller fleets in particular exit the industry, inventory continues to increase. This is providing remaining fleets with more options than they have had in a long time.”

Auction sales were up 32% in May, ACT reports.

Tam concluded: “Despite the current anemic economic and soft freight conditions, the comparison highlights just how tough conditions were in 2022 with respect to scarce inventory. As the year progresses, the year-to-date scenario also continues to diverge from last year.”