In 2022, the trucking business became more expensive compared to the previous year. This increase in costs was attributed to various factors, including higher driver wages and increased fuel prices. The American Transportation Research Institute (ATRI) conducted an analysis of the operational costs of trucking, revealing these cost increases.

According to the ATRI study, total marginal costs reached a new high in 2022, marking the second consecutive year of increase. The costs rose by 21.3 percent compared to 2021, surpassing the two-dollar mark and reaching $2.251 per mile. Fuel expenses played a significant role in this spike, with costs rising by 53.7 percent compared to the previous year.

In addition to fuel costs, several other expenses also experienced double-digit growth. Driver wages increased by 15.5 percent, amounting to $0.724 per mile, reflecting the industry’s ongoing efforts to attract and retain drivers. However, driver benefits remained stable in 2022, as reported by ATRI.

The ATRI study involved a record number of motor carriers, providing insights into various line item costs, operational efficiencies, and revenue benchmarks based on fleet size and sector. Unusual market conditions in 2022 posed challenges for acquiring and maintaining equipment. Truck and trailer payments increased by 18.6 percent to $0.331 per mile due to higher prices resulting from equipment supply chain issues. Additionally, parts shortages and rising technician labor rates led to a 12 percent increase in repair and maintenance costs, reaching $0.196 per mile.

Motor carriers responded to rising costs by implementing improvements in key operational efficiencies. Driver turnover, detention times, and equipment utilization showed improvements across nearly every fleet size and sector during 2022, according to the ATRI study. The report also introduced new metrics, such as mileage between breakdowns and the ratio of truck drivers to non-driving employees.

Despite falling rates over the year, average operating margins remained at least 6 percent in all sectors. While larger fleets experienced improved average operating margins from 2021 to 2022, smaller fleets saw a decline in operating margins.

Driver Pay

In 2022, total driver compensation in the trucking industry experienced a significant increase of 12.3 percent, surpassing the rate of increase seen in 2021. Surprisingly, despite a softer freight market, employment in the trucking industry continued to grow.

On average, the trucking industry spent 90.7 cents per mile on combined driver pay and benefits in 2022. While benefits remained unchanged from 2021, wages witnessed a notable rise of over 15 percent. In the case of truckload wages, there was a trend of increasing wages as fleet size grew, which was contrary to the results of the previous year. In other words, larger truckload fleets slightly spent less on company driver wages compared to their smaller counterparts. This means that larger fleets implemented a greater percentage increase in company driver wages in 2022.

ATRI reported that specialized carriers had an even stronger inclination to increase driver wages with the growth of their fleet size. This pay differential can be attributed in part to the fact that many small fleets in this sector had highly specialized operations, often involving supplemental pay or bonuses, such as load-specific oversize or loading pay. Larger fleets were less likely to offer such incentives.

In 2022, less-than-truckload (LTL) carriers paid an average of 78.0 cents per mile in driver wages, compared to 70.2 cents per mile in 2021. Over the past year, the wage gap between LTL drivers and historically lower-paid truckload drivers narrowed, driven by competitive labor market pressures.

Driver Benefits

In 2022, the average costs of truckload driver benefits showed a correlation with fleet size. While there was little disparity in benefits costs among the largest four truckload fleet size categories in 2021, truckload fleets with over 250 trucks experienced a higher rate of increase in benefits spending compared to their counterparts.

It was found that 11 percent of truckload carriers did not provide benefits to their drivers.

On the other hand, LTL carriers had significantly higher average driver benefits costs, amounting to 28.0 cents per mile. This figure surpassed those of any other fleet sector or size category. The increase in the overall industry average benefits cost per mile in 2022 was influenced primarily by the higher costs observed in the LTL sector. In contrast, specialized carriers across all fleet sizes spent less on benefits in 2022 compared to the previous year. Among specialized fleets, the highest benefits costs were seen in the 101 to 250 truck category, with a decline in costs among larger fleets.

Thirteen percent of specialized carriers did not offer benefits to their drivers.

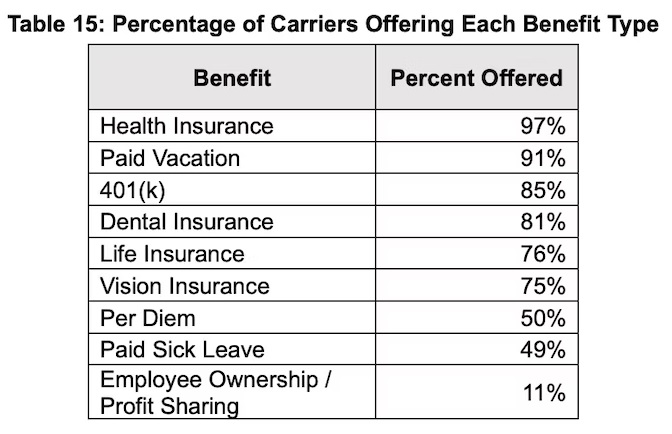

Among carriers, the two most prevalent company driver benefits offered were health insurance, provided by 97 percent of carriers, and paid vacation, offered by 91 percent of carriers.

There was a decline in the percentage of carriers offering per diems, which are daily allowances for expenses, while there was an increase in the percentage of carriers offering paid sick leave.

Additionally, 11 percent of carriers engaged in employee ownership or profit-sharing arrangements, indicating a commitment to involving employees in the company’s success and sharing profits.

Driver Bonuses

According to the ATRI findings, driver bonuses have gained significant importance as a supplemental form of compensation in 2022, and a majority of carriers incorporated them into their compensation packages. The primary reason for this is that bonuses serve as rewards for specific performance goals achieved by both the carrier and the driver. Particularly for specialized carriers, driver bonuses constitute a significant portion of the overall compensation structure.

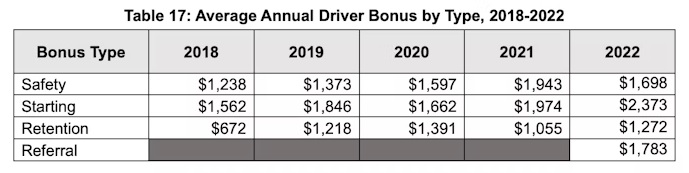

In 2022, starting bonuses continued to be the highest among the four bonus categories. Carriers offered competitive starting bonuses to attract top talent in a labor market that remained competitive. However, it’s important to note that starting bonuses are typically given only once, while other types of bonuses are awarded more frequently.

Referral bonuses, introduced for the first time in 2022, ranked as the second-highest bonus category. These bonuses were provided to drivers who successfully referred new qualified drivers to the company.

Retention bonuses experienced a recovery in 2022 following a dip in 2021. Some carriers award retention bonuses annually, while others do so at specific milestones, such as every five years of continuous employment. These bonuses aim to incentivize drivers to stay with the company over the long term.

On the other hand, safety bonuses witnessed a decline from their peak in 2021. Although safety bonuses historically remained high, their significant drop occurred at a time when crashes and associated costs, including litigation expenses, were on the rise.

Overall, driver bonuses have become an integral part of compensation packages in the trucking industry, serving as a means to reward performance and incentivize driver retention.

ATRI’s research also found:

- Truckload, tanker, and refrigerated carriers each had three drivers for every non-driving employee on average in 2022. Flatbed carriers had a slightly higher average of 3.3 drivers for every non-driving employee. LTL carriers, with their much more personnel-intensive business model, employed just 1.4 drivers for every non-driver.

- Turnover rates declined in almost every sector and fleet size category from 2021 to 2022, possibly due to driver concerns about falling freight volume. Smaller fleets generally have lower turnover regardless of sector while larger fleets generally have turnover rates that exceed 50 percent. Truckload carriers experienced higher turnover than all other sectors except in fleets with fewer than 100 trucks. In 2022, though, truckload fleets of all sizes saw improvements in turnover rates, with the strongest improvement in fleets with more than 1,000 trucks.

- Speed governor use remained high in 2022, at 93 percent of carrier respondents. This was in part due to 2022’s exceptionally high fuel costs, as speed governors help improve fuel efficiency. There is a historical relationship between a year’s average diesel price and the percentage of carriers utilizing speed governors.

According to ATRI, the bearish economy expected in 2023 will introduce a significant level of uncertainty for carriers. They will need to closely monitor and prioritize their expenses in order to ensure financial stability. Despite the challenging economic conditions, the trucking industry has made significant progress in various aspects over the past two years. This progress includes the adoption of newer equipment, offering more competitive compensation for drivers, and enhancing overall operations. These advancements have positioned the industry well to effectively confront the upcoming challenges.