Publicly traded fleets in the United States have started revealing their Q1 earnings and the results are not positive. Smaller carriers are being forced out of the market due to spot market rates that are still lower than operating costs. Despite this, the demand for equipment remains steady, although it is not at the same level as in the past.

According to industry forecaster FTR, the trucking industry has been experiencing deteriorating conditions, with truck tonnage seeing its most significant drop since the beginning of the pandemic.

Here are some of the economic updates from the previous week, as presented in our first weekly Economic Trucking Trends roundup. Let’s dive into the details:

U.S. earnings season off to ominous start

Publicly traded US trucking companies have started revealing their Q1 earnings, which reveal a tough operating environment. For instance, J.B. Hunt reported a 7% decline in Q1 revenue.

J.B. Hunt experienced a significant drop in its truckload revenue per load, which fell by 17%, while final mile services also saw a similar decline. The company’s Marketplace for J.B. Hunt 360 platform was hit particularly hard, with a 38% decrease in total freight transactions, which is quite startling.

President Shelley Simpson had this to say to analysts on an earnings call: “We’re in a challenging freight environment where there is deflationary price pressure for an industry that continues to face inflationary cost pressures. Simply stated, we’re in a freight recession.”

The story was similar elsewhere. Knight-Swift reported a 10.4% decrease in revenue and a 49.9% decrease in consolidated net income. Truckload revenue fell 8% year over year.

“The unusually soft demand experienced in the fourth quarter of 2022 continued through the first quarter of 2023, as demand proved worse than expected,” CEO David Jackson said in a release. “This weakness in demand has continued thus far in April.”

In contrast, Marten Transport had a better performance, as it exceeded earnings expectations and saw a 3.7% improvement in operating revenue during Q1. However, executive chairman Randolph L. Marten predicted that the present market conditions will lead to the demise of several smaller carriers.“The market has become unsustainable for the smaller carriers who comprise a significant portion of total capacity, and who are expected to continue the recent increased industry exit rate,” he said in a release.

Capacity rebalancing underway

According to industry analyst ACT Research, freight demand is expected to remain weak for a while, and the key to restoring balance lies in removing capacity. The report suggests that significant rebalancing measures will be necessary to get the industry back on track.

“Spot rates are now about 17% below truckload fleet operating costs in Q2, worse than the 15% operating loss in Q1, by our estimates,” said Tim Denoyer, ACT Research’s vice-president and senior analyst.

“Failures started to pick up when the loss reached 10% in Q4 2022. This was a record at the time, and we see Newton’s third law of motion at work as the rebalancing requires a string of record losses following record pandemic profits. Q2 is the fourth straight quarter of significant losses, and both the time and magnitude of the losses should send a strong enough signal to tighten capacity.”

He added, “The pendulum of pricing power has been firmly with shippers for some time, and the cudgel of lower rates is starting to impact capacity. Though new equipment production remains elevated, hiring and fleet exit trends tell us capacity is slowing at the margin. With marginal fleets scrambling for miles with busted budgets, spot rates have gone far below costs, but this can only go on so long.”

Freight conditions deteriorating

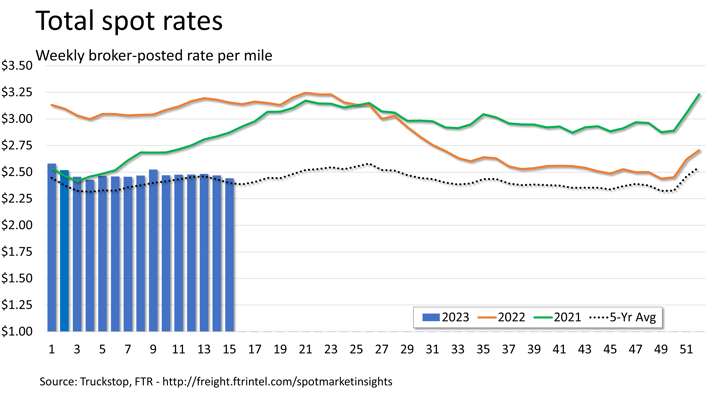

The spot market for trucking services continues to be strained, as per the data reported by Truckstop and FTR Transportation Intelligence for the week ending on April 14. The data indicates that there is still persistent weakness in spot rates for dry van and refrigerated freight.(see chart above)

“In the latest week, both segments saw their largest drop in broker-posted rates since January. Dry van rates have retreated for six straight weeks and have declined in 12 of 15 weeks this year,” the companies report. “Refrigerated rates declined for the fourth consecutive week and have fallen in all but four weeks this year. Flatbed rates essentially held steady during the week, eking out a marginal gain over the prior week.”

Even carriers that primarily transport contract freight have not been spared from the industry slowdown. The American Trucking Associations (ATA) reported a 5.4% decrease in for-hire truck tonnage volumes in March, which is the biggest sequential drop since the pandemic’s onset and the first year-over-year decline since August 2021.

The Trucking Conditions Index, which is a measure of the trucking industry’s conditions forecasted by FTR, declined from -1.71 in January to -5.17 in February. The decrease indicates that the trucking conditions have worsened, as per the industry forecaster.

“Freight volume is holding up better than many anticipated, but downside risks are substantial,” said FTR’s vice-president of trucking Avery Vise. “Although fears of a major banking crisis have abated since March, tighter lending standards by banks on top of the Federal Reserve’s interest rate hikes could slow the economy further.”

Trailer demand slows, remains healthy

Preliminary data from ACT Research reveals that trailer orders plummeted by 33% in March when compared to February, with only 16,800 units ordered. The data also shows a massive 56% decline in year-over-year trailer orders.

ACT Research noted that the decrease in trailer orders happened earlier than anticipated. However, Jennifer McNealy, the director of commercial vehicle market research and publications, said that the current demand for trailers remains healthy despite the decline in orders.

“Orders pulling back in March is a month earlier than normal seasonality would suggest, but near record-level order backlogs are easy to point to in explaining away the earlier-than-expected deceleration,” she said. “Despite March’s drop in orders, we believe demand remains healthy and we’re seeing improved, albeit still somewhat challenged, build data.”