J.B. Hunt Transport Services’ financial results for the first quarter were lower than the previous year, due to a decrease in container imports on the West Coast and a decline in domestic trucking volumes.

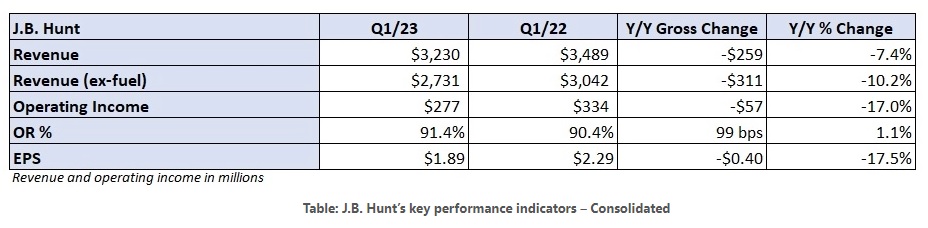

J.B. Hunt (NASDAQ: JBHT) announced its quarterly earnings report on Monday after the market closed, reporting earnings per share of $1.89. This represents a 40 cent decline compared to the previous year and falls short of the consensus estimate by 13 cents. The company faced additional challenges including a loss from disposing of equipment compared to a gain last year, resulting in a 17 cent difference. Furthermore, higher interest rates led to a 2 cent impact on earnings as interest expense increased by 18% despite a slightly reduced debt load.

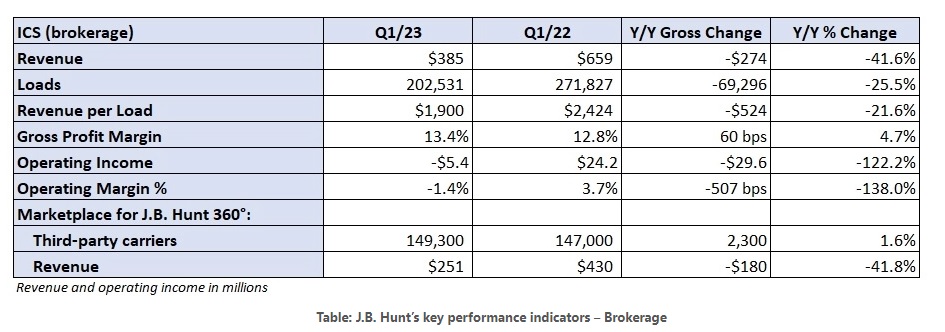

The company’s management referred to a “freight recession,” which had a significant impact on their brokerage unit. This was reflected in a sharp decline in revenue, which fell by 42% year-over-year to $385 million. The decrease was due to a decrease in loads by 26% and a decline in yields by 22%.

Contractual revenue made up 64% of the total revenue, which was a significant increase from the previous year’s 42%. Despite a 60-basis-point rise in gross margin, the division suffered an operating loss of $5.4 million, which was almost $30 million worse than the same period the previous year. This loss was due to a decline in total gross profit dollars, resulting from lower volumes and yields, as well as increased insurance costs.

During a call with analysts, the company’s management stated that the spot market seems to be stabilizing, as a large number of carriers are currently operating at a loss and cannot afford any further declines in spot rates. President Shelley Simpson noted that this situation is unlikely to continue for an extended period, as it is unsustainable in the long term.

She said the company’s customers are “struggling to forecast what consumers are going to do,” which has resulted in a “more cautious” outlook internally.

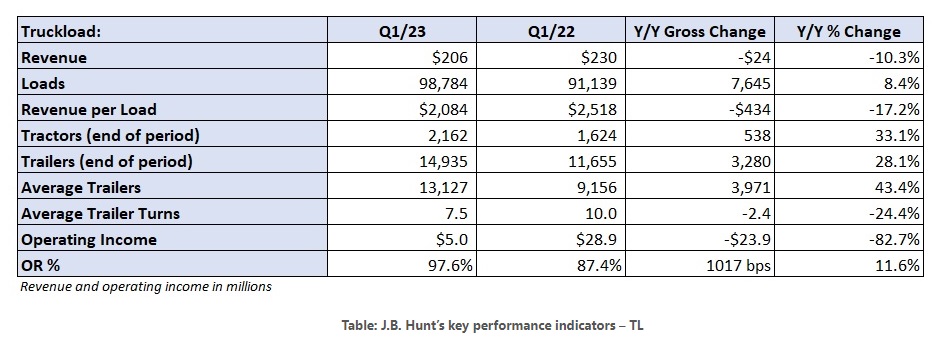

The company’s TL (truckload) results were negatively impacted by a looser trucking market. Revenue decreased by 10% year-over-year to $206 million, with revenue per load falling by 17%, although this was partially offset by an 8% increase in volumes. The primary metric for asset utilization in this division is the average loads per trailer, which decreased by 24% year-over-year. The company’s management announced that it moved most of its remaining company-owned trucking operations from the TL segment to the dedicated unit at the beginning of the year. The TL segment’s operating ratio was 97.6%, which was 1,020 basis points worse than the same period last year.

Intermodal’s spring to remain coiled

The company’s management frequently mentions the recent intermodal capacity additions as a “coiled spring,” which they expect will result in significant growth when demand returns. However, it seems that this expected freight windfall will have to wait, as container imports into the U.S. have declined by almost 30% year-over-year over the past two months.

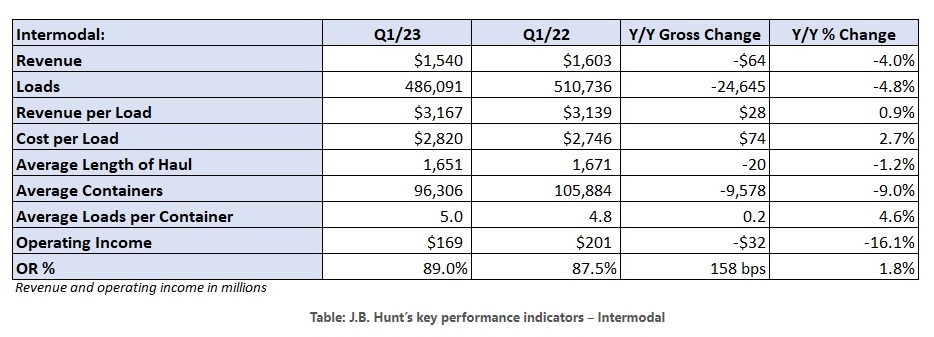

J.B. Hunt’s intermodal loadings decreased by 5% year-over-year during the period, which was a better result than the overall intermodal traffic decline of 10% on the U.S. Class I railroads, according to data from the Association of American Railroads.

Transcontinental loads were down 9% year-over-year, with inbound containers to the West Coast experiencing the highest rate of decline. However, this was partly offset by a 1% increase in Eastern loads, which have a shorter length of haul. The year-over-year declines across the platform accelerated as the quarter progressed, with a 2% decline in January, a 4% decline in February, and an 8% decline in March.

Improved service from the railroads and faster container handling by customers at their warehouses led to a 5% year-over-year increase in the average box turns to five times per quarter. However, the average number of containers in service decreased by 9%, as 17% of the box fleet was idle due to weak demand. Revenue per load increased by only 1% during the quarter and remained flat when excluding fuel surcharges. Overall, the division’s revenue decreased by 4% year-over-year to $1.54 billion.

J.B. Hunt’s management mentioned that they had won a significant amount of intermodal freight in recent negotiations, but these loads have not yet appeared in the network. The current bid compliance level is at an all-time low, which is approximately in the mid-50% range.

“At this point, our customers have been less accurate than ever before,” said Darren Field, president of intermodal. “I think we’re winning volume that our customers believe that they will have and we’re encouraged by price in that I don’t think that it’s behaved any more challenging than what we expected coming into the year.”

Although J.B. Hunt’s network is currently oversupplied from a capacity standpoint, recent investments have enabled the company to take on another 15% to 20% of incremental volume once demand improves. The company anticipates that future volume wins will enhance the impact of ongoing cost and safety initiatives.

J.B. Hunt’s intermodal division recorded an 89% operating ratio (OR), which was 160 basis points worse than the previous year, as costs per load increased by 180 basis points faster than revenue per load. The division experienced most of the year-over-year declines in gains on sale booked during the quarter.

Source: www.freightwaves.com